Mayor Asks City Council to Approve November Override Vote

By Ellen Putnam

Mayor Jen Grigoraitis, left, and CFO Kerri Golden at Tuesday's meeting

Screenshot from MMTV

At Tuesday’s meeting of the Appropriations and Oversight Committee of the City Council, Mayor Jen Grigoraitis presented a proposal for three property tax override questions to be placed on the ballot in November.

These three questions will be tiered - an unusual form of override question where voters can select from different override amounts, with the highest winning amount, if any, going into effect - and offer a potential override of $9.3 million, $11.9 million, or $13.5 million. All of the potential override amounts would stabilize city finances at next year's levels through 2029, and the higher levels could reverse some cuts to city services and the Melrose Public Schools (MPS).

Over the last two years, rising costs that have outpaced revenue in a number of areas have resulted in substantial service cuts in the city’s budget, including over $6 million in cuts for Fiscal Year 2026 (FY26), which starts in July. This includes nearly 50 layoffs in MPS over the last two years, along with positions left unfilled in a number of departments across the city. A $7.7 million override vote last June, which would have avoided those cuts, was rejected by Melrose voters, 55% to 45%.

Service cuts in many parts of the budget are already approaching noncompliance with contractual obligations and state and federal law. And the cost increases that resulted in this year's budget deficit are expected to continue into next year and for the foreseeable future.

All twelve union contracts with the city and schools, including for teachers, police officers, and firefighters, will expire at the end of next year and need to be renegotiated, likely resulting in higher salary costs. And a number of costs within the budget are increasing faster than revenue can. In FY26:

- Health insurance premiums for employees will increase by 12%;

- Property insurance on municipal buildings will increase by 4.4%;

- Required payments into the city’s pension system will increase by 3.5%

- Tuition payments for students who attend regional vocational schools, including Northeast Metropolitan Regional Vocational Technical School in Wakefield, will increase by over 20%, in large part due to the construction of Northeast's new school building;

- Out-of-district tuition and transportation costs for students with disabilities will each increase by more than 8%.

“The cuts we have made over the last several years are not sustainable,” Grigoraitis told the City Council, “and what’s to come, without additional funding, will be even worse. As of today, our budget forecast model indicates that, without an override, we will be $4 million short of the revenue needed to maintain level services from FY26, a budget in which we have eliminated positions across the city and schools, into FY27.”

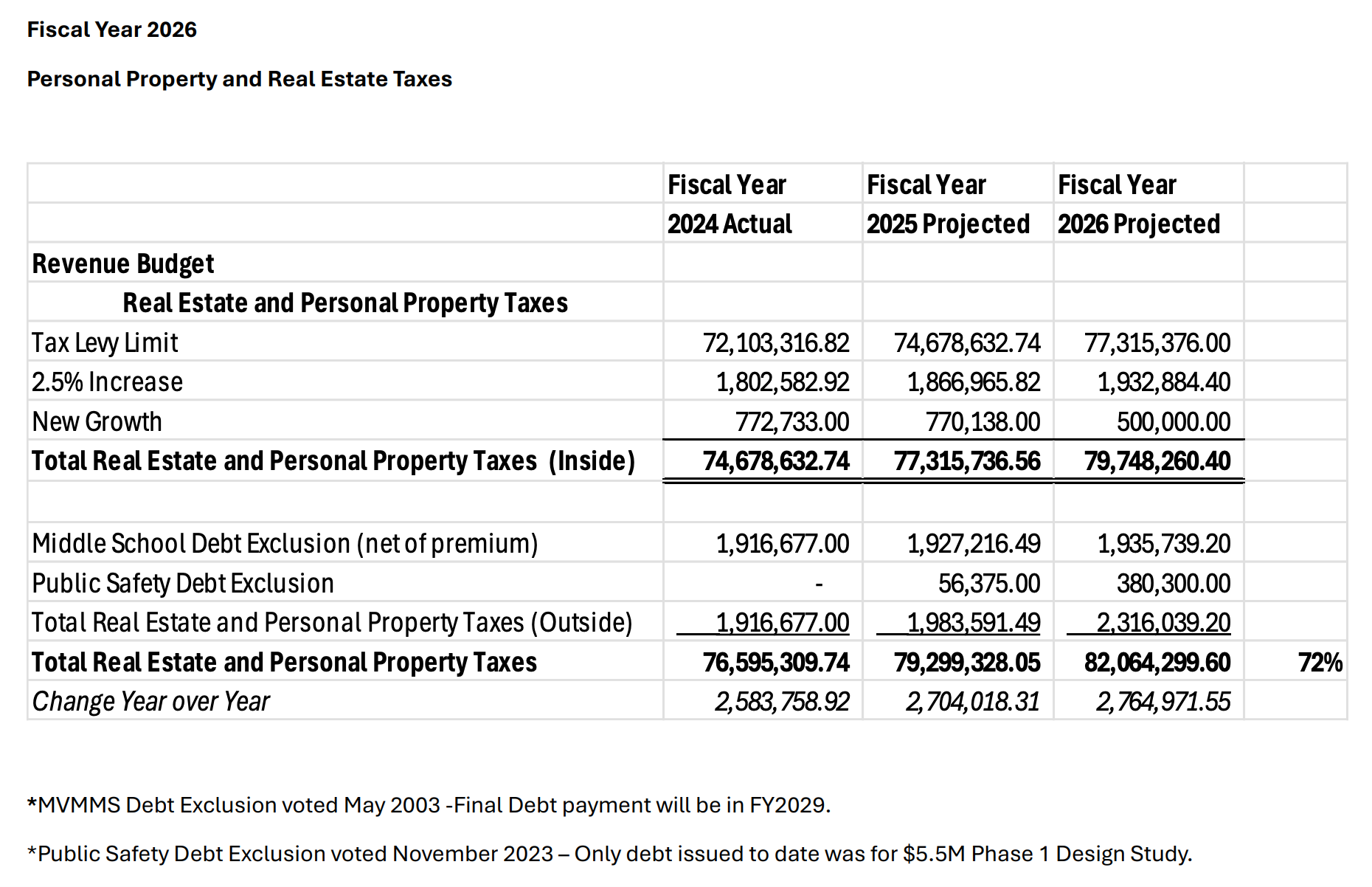

Melrose's property tax levy in FY24, FY25, and FY26

Proposition 2½, a 1980 statewide ballot measure, prohibits cities and towns from increasing the total amount they collect in property taxes each year by more than 2.5%, plus some amount calculated to reflect new growth, unless voters pass a property tax override for a specific amount to be added to the total property tax levy. Melrose did pass an override in 2019, its first since 1993.

Grigoraitis stated that, while some residents have proposed other possible funding sources for the city, “under Massachusetts law, only one recourse is available to the city to raise revenue at the magnitude our budget demands: the Proposition 2½ override.”

The proposed override questions for November’s ballot come from a unanimous recommendation by the Financial Task Force, which Mayor Grigoraitis convened earlier this year for the purpose of taking in public feedback and deciding on override questions for the November ballot. The Task Force included Mayor Grigoraitis, the city’s Chief Financial Officer Kerri Golden, Superintendent Adam Deleidi, MPS Finance Director Ken Kelley, City Council President Leila Migliorelli and Ward 4 Councilor Mark Garipay, and School Committee members Dorie Withey and Jen McAndrew.

Grigoraitis explained that the task force reviewed guidance from the state’s Division of Local Services and looked at override questions, both successful and not, from other cities and towns in the region. The task force also “discussed staffing needs and requirements in the city and schools; revenue and expense forecasts; and anticipated increases to major cost drivers, such as union employee contracts, regional school assessments, pension obligations, employee benefits, school transportation, and special education costs.”

The task force also received feedback from residents on their funding priorities and what they wanted to see in a potential override proposal, which included “considering multiple options rather than an ‘all or nothing’ single override ballot question; cautioning against pitting different parts of the city in opposition to one another; designating revenues raised by an override to clear priorities; and increased transparency.”

With these constraints in mind, the Financial Task Force recommended three tiers for an override vote, which would do the following:

- $9.3 million would “stabilize services at the current reduced levels, preventing further job cuts”;

- $11.9 million would “partially restore essential city and school services, reversing recent significant job and program cuts”;

- $13.5 million would “substantially restore essential city and school services and positions and invest in additional infrastructure”;

Each of these three amounts will be a separate ballot question with two options: yes or no. If more than one question receives more than 50% “yes” votes, the “question specifying the highest dollar amount” would prevail - not the question with the most votes - and only one dollar amount would go into effect.

“We recommend this format because it provides multiple options to voters,” explained Grigoraitis. “It also clearly delineates what we can and cannot restore in the event of passage—there is no practical way to turn the clock back to a previous year and restore every budget cut, but we can target some of our top priorities for restoration and even reinvestment.”

“All three options,” Grigoraitis continued, “plan for, and include funding for, the next contract cycle (three years through FY29) for all city and school employee union contracts and some level of funding for repairs to infrastructure (roads, sidewalks, parks, and buildings), although the amount of investment in restoring lost positions and in improving infrastructure will be determined by the level of funding voted in by the community.”

Proposed text for override questions for November

“I think people really want a plan,” Grigoraitis went on, “which is something we are very much working on. We want to be sure that we are actually looking forward through the entire lifespan of our contracts. And we want to make sure that we are forward-looking about all of our cost drivers, to ensure that we are not just promising to add things back and then not able to sustain those costs going forward. So we did really try to make sure that each of these numbers stabilize what we currently have and allow us to move forward through what we know is coming, which is union negotiations with every single union.”

While the two higher override options would restore some positions and budget items that have been cut over the last two years, none of the override options would fully return staffing and city services in Melrose to the levels they were at in FY24. “To fund a full restoration of the city and school positions that were reduced over the past two fiscal years and plan to carry forward all of those costs for three years would require approximately a $20 million override,” the task force's memo noted.

That, Grigoraitis pointed out to the City Council, would be the largest override sought by any municipality in Massachusetts, eclipsing Stoneham’s recent failed override ($14.6 million) and a successful override for $12 million passed in Brookline two years ago. “That did not feel like the right thing for Melrose,” Grigoraitis added, “and candidly, it also felt like an unfair ask of our residents. So we can’t gain it all back in one fell swoop. I just don’t think that’s possible.”

While City Councilors approved of providing voters with three choices, rather than an all-or-nothing approach, some worried that the format, which is not often used for override questions, could be confusing to voters. “We don’t want to be in the position where we could lose potential votes on level one or level two,” said Ward 3 City Councilor Robb Stewart, “because a voter thought they only had to pick one, and voted no on the others.”

Councilors also appreciated the level of detail Grigoraitis and her administration have provided to voters so far in the budget process. “I know that the residents in our community have asked for transparency,” said Ward 1 Councilor Manjula Karamcheti, “and I feel that the way you’ve presented the information has been very transparent. I think the trust of the folks involved matters.”

A successful override vote would ensure Melrose's financial stability for the next few years based on the city's current calculations, but those could be thrown off if there are significant changes to federal and state funding.

“What is not factored in here is, should the federal government significantly change how it chooses to fund states,” Grigoraitis emphasized. “We’ve done some work in partnership with the City Council to prepare for some of that. But if the way government is funded from the federal level on down is completely upended, that is not reflected in here. And I’m not actually sure we could actively prepare for that in a reasonable way.”

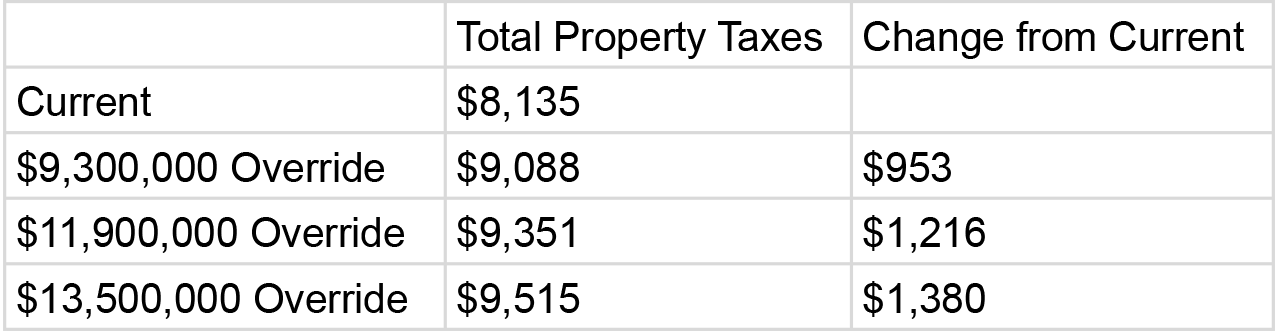

The impact of each override amount on property taxes for a home assessed at $821,716 (the average home value in Melrose)

Data from the Division of Local Services Property Tax Impact Calculator

The Appropriations Committee, which is made up of all eleven City Council members, voted unanimously to recommend the override questions to the full City Council when it meets again next week. Unless a majority of the members change their votes between now and then, Melrose voters can expect the three override questions listed above to appear on the ballot during November’s municipal election.

If one of the override questions does pass in November, the tax rate for FY26 can be changed midyear, allowing the city to potentially restore some of the cuts to services that are being made for FY26.

“We had a lot of discussion on the task force,” reflected Garipay. “I changed my opinion three different times. And I was going back and forth between one question and three, and I just thought, over my time in Melrose, we’ve probably had five or six overrides, and only one has passed. And I think maybe it’s time to look at it a little differently.”

Follow Us: